Image source: https://image.slidesharecdn.com/recessionitseffectsppt-121023155405-phpapp02/95/recession-its-effects-ppt-2-638.jpg?cb=1351007731

Frank Knight, the neatly-appeared US economist, taught us to distinguish among threat and uncertainty. Situations with threat had been the ones where the outcomes had been unknown in spite of this governed simply by threat distributions appeared at the outset. Knight argued that these cases, where determination-making requirements related to maximizing predicted merit will probably be utilized, fluctuate in a deep method from "doubtful" ones, in which now now not just the outcomes, in spite of this even the threat versions that govern them, are unknown. This is a unbelievable description of the contemporary difficulty in which we may need to paintings out the of multiplied uncertainty on fiscal boom, predicted revenue and returns on genuine property investments.

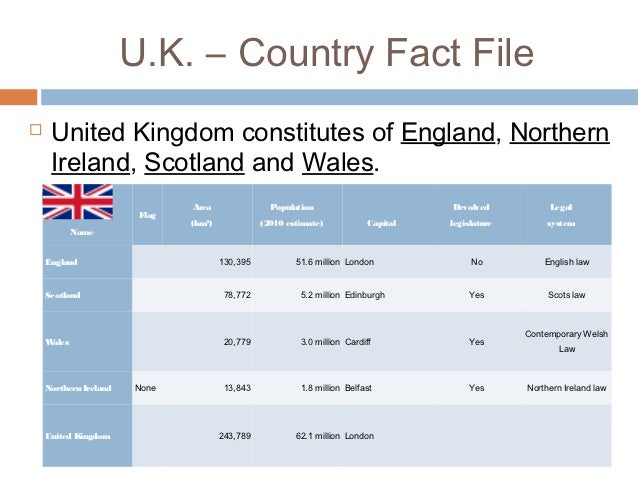

Palos Verdes, CA. When a majority of the united kingdom populace determined to depart the European Union (EU), their determination unleashed uncertainty on genuine property markets and discovered out the perplexity on every human being unmarried facet of the Channel style of requirements to contend with this difficulty.

However, it has grow to be exceedingly robust to forecast the funding outlook from the subsequent. This is now an slightly state-of-the-art difficulty for which no one has proven a plausible solution. Will other member countries comply with the representation of the united kingdom? We smoothly do now now not realize, and it flavor of feels steady to claim that irrespective of what deeply severe has changed.

The outlook for greater premiums throughout the US has changed, in our view. Drag might presumably just presumably also neatly now stem from heightened uncertainty therefore fiscal improvements, primarily from the fallout from the EU referendum vote and the US elections. With these and other impacts, the Feds will increase up hobby fee normalization at least unless December, in spite of this presumably later, dependent on the of aas a rule greater growths and the unfamiliar consequences of slower boom in Europe on the US fiscal formulation.

The determination of the united kingdom to depart the EU and the attached adverse on boom aren't come as a shock. We would are awaiting the principle hobby fee hike to be behind time table simply by style of two years to mid-2019 and are forecasting a fee lower next summer.

No doubt, genuine property has started out to re-fee reflecting heightened doubt, the threat of slower boom in Europe, and the competencies for deeper contagion to our fiscal formulation.

The worldwide-famend UK economist John Maynard Keynes showed how uncertainty impacts the determination-making method of households, the traders in his neatly-appeared treatise "The General Theory of Employment, Interest and Money" from 1936. If the of a difficulty related to the contemporary one throughout the united kingdom is assessed as doubtful with pleasure in to jobs, long time period demand, long time period get entry to to markets, long time period bills and the free movement of labor picking out the long time period shipping of labor, it actually is rational for households to augment their financial savings as an upkeep toward competencies long time period unemployment, as it actually is rational to lower funding spending. As a outcome, demand declines and fiscal boom weakens.

In anticipation of lower or even shrinking fiscal boom, traders sell genuine property, as they are awaiting values to fall. Slower boom confirms the principle evaluate of households, prompting extra financial savings and even extra cuts in funding spending. This method is neatly known as a self-proper quality prophecy and can lead to a deep recession. We do now now not yet predict one, in spite of this on the full founded on our reasoning, we come to the conclusion that an extended period of uncertainty will dampen fiscal game. How deep the lower in boom will probably be is based upon the length of the period of uncertainty and predicted outcomes, which also rely on every human being unmarried other. Given the heightened stage of uncertainty, we are now now not able to pencil in individual numbers, in spite of this we assume that the contemporary stipulations will weigh strongly on our fiscal boom.